The alternative and private fund world isn’t just evolving – it’s accelerating. Regulatory scrutiny is rising. Investor expectations are growing. And operational efficiency has become the baseline. In 2025, fund managers looking to stay competitive are turning to AI-powered onboarding tools to transform how they verify and engage investors.

From reducing onboarding timelines to strengthening compliance, AI is fast becoming the backbone of modern investor onboarding.

Why Onboarding Still Slows Funds Down

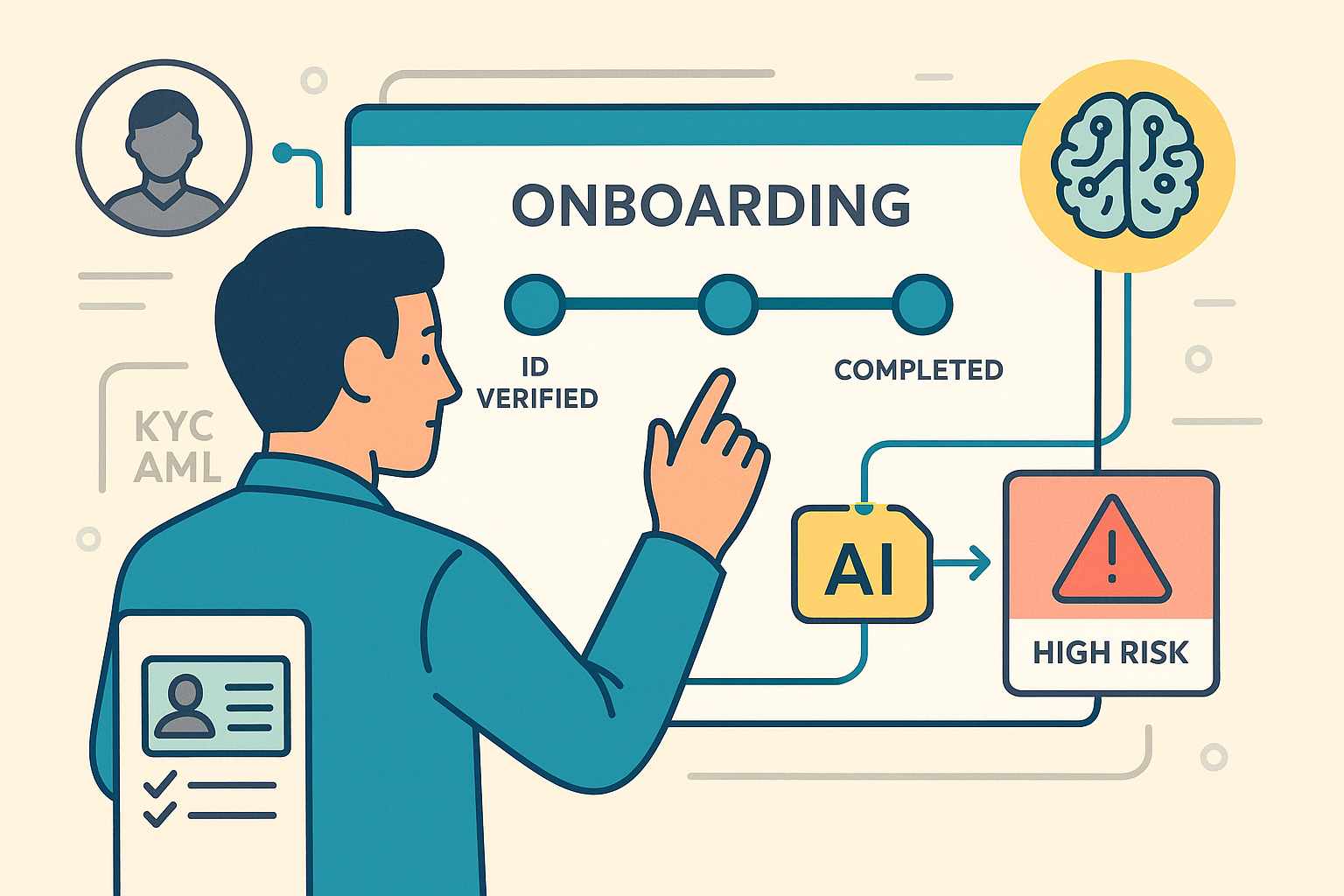

Despite advances in trading and portfolio tech, many funds still rely on outdated onboarding practices. These often involve manual checklists, Excel spreadsheets, long email threads, and disconnected compliance tools. The result? Delays, errors, and regulatory risk – especially around KYC and AML. More importantly, these processes weaken the investor experience right from the start.

What AI-Powered Onboarding Looks Like

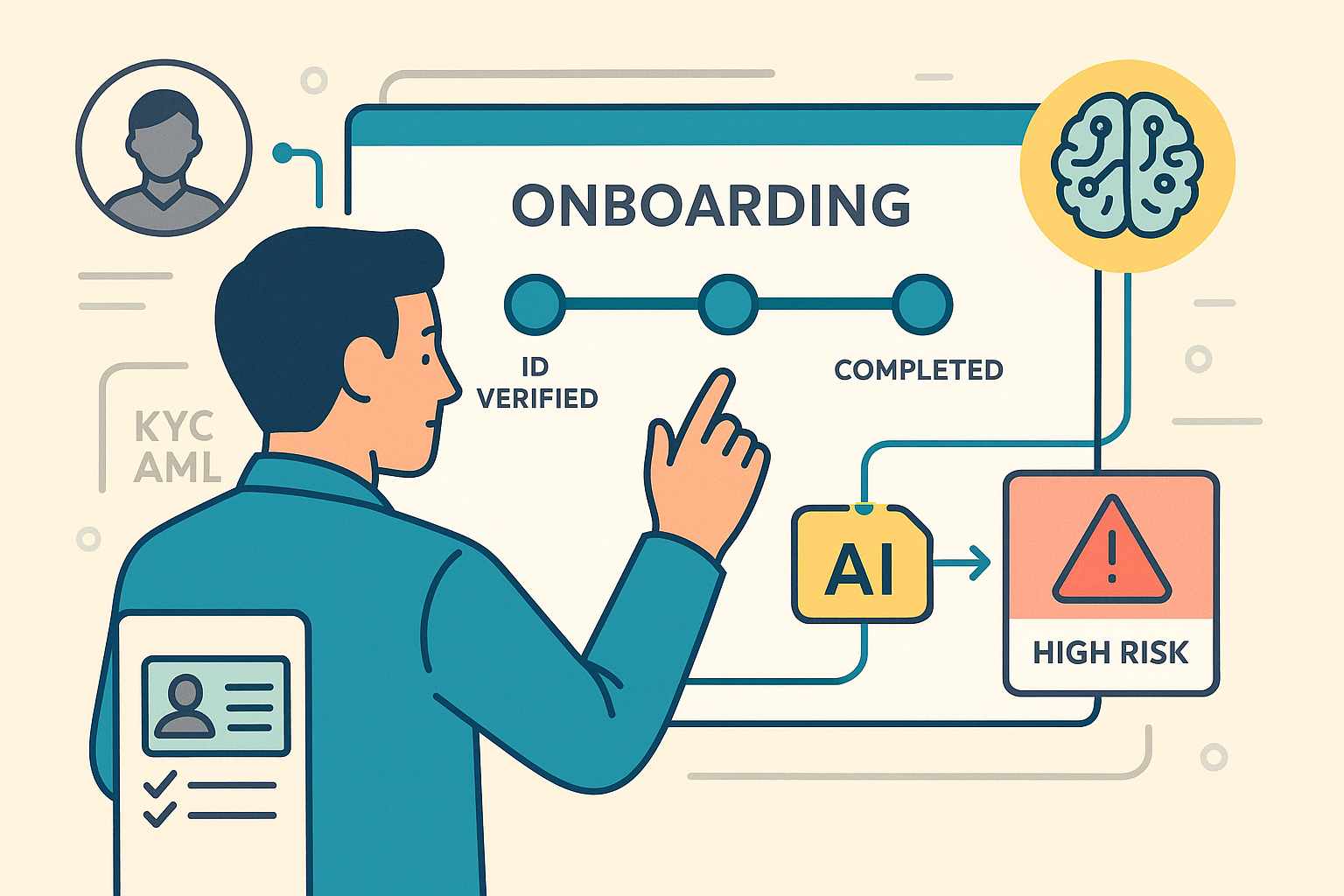

Modern onboarding platforms are changing the game. Static, step-by-step processes are being replaced with dynamic, rules-based workflows. These adjust in real time to investor profiles, jurisdictions, and risk indicators.

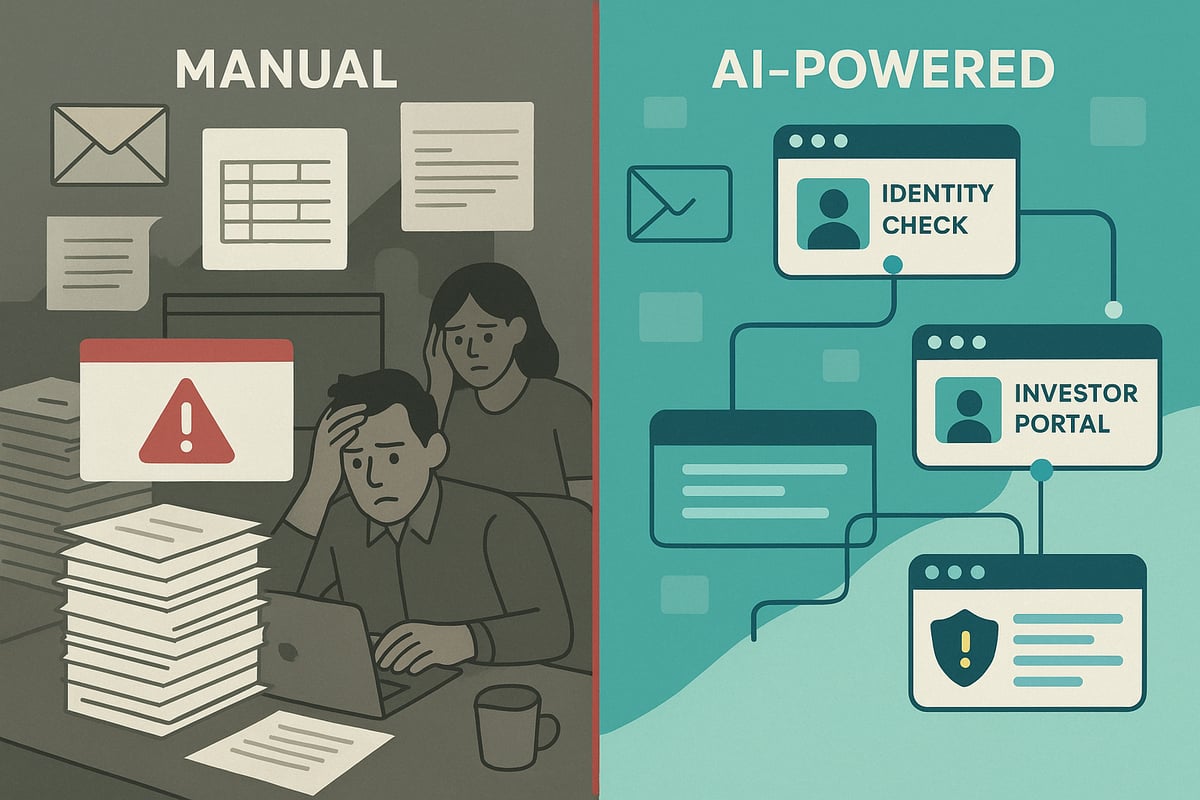

For example, fund managers using Mesh ID can now:

• Automatically trigger Enhanced Due Diligence requests based on profile signals

• Route high-risk profiles directly to compliance teams

• Notify stakeholders when onboarding gets stuck

• Record every interaction for regulatory audit readiness

In many cases, onboarding cycles have dropped from 8–12 weeks to just 2 weeks.

Removing Manual Bottlenecks

AI onboarding platforms do more than collect data. They manage the full flow of tasks between teams, eliminating repetitive handoffs.

Identity documents are automatically verified. Risk-based reviews are triggered at the right time. All investor communication is tracked through one secure portal. Periodic KYC updates are scheduled and managed without manual input.

This kind of orchestration frees up compliance and investor relations teams to focus on more valuable work – like analyzing risk and deepening client relationships.

Reducing Regulatory Risk with Better Data

AI tools validate and cross-reference investor data in real time. If a submitted ID doesn’t match the jurisdictional profile, the system flags it immediately. This reduces the chances of missing red flags and helps teams meet fast-changing KYC and AML requirements.

Audit logs are generated automatically. Compliance teams get better oversight with fewer manual checks.

Building a Better Investor Experience

Today’s investors expect smooth, digital onboarding. Clunky or confusing processes create drop-off and erode trust.

With AI-driven platforms, firms can offer a guided, low-friction experience. Forms are pre-filled using existing data. Investors receive smart prompts and real-time status updates. Fewer emails. Faster completion. A better first impression.

Getting Started Without a Full Overhaul

You don’t need to rebuild your stack to see results. Many firms begin by identifying their biggest onboarding bottlenecks and automating those specific areas.

Start by mapping out your current onboarding process. Find the delays and duplicated tasks. Integrate a system like Mesh ID to automate where it counts. Build workflows based on risk profiles. Train your team and monitor improvements.

Even small changes can unlock meaningful efficiency and stronger compliance.

Final Thoughts

In 2025, onboarding is no longer just paperwork. It’s a key part of your investor experience, risk posture, and internal efficiency. AI-powered platforms like Mesh ID are helping firms cut onboarding timelines by up to 80 percent, reduce risk, and build trust from day one.

If your team is exploring better ways to manage onboarding, we’d be happy to share what’s working across the industry.