Compliance leaders are under pressure to move faster, stay compliant, and improve collaboration across teams. Many have invested in onboarding tools—but still hit the same wall: their data isn’t structured. And without structured data, transformation stalls.

This blog explores why structured compliance data matters, what it enables, and how firms are starting to build for it.

The Problem with Today’s Tools

Even with digital onboarding platforms, many workflows still rely on outdated practices. Teams often re-enter the same data across tools, checklists live in spreadsheets, forms are shared as static PDFs, and communication between compliance and the front office happens in silos. The result? Onboarding is slow, inconsistent, and frustrating for both staff and clients.

What Structured Data Really Means

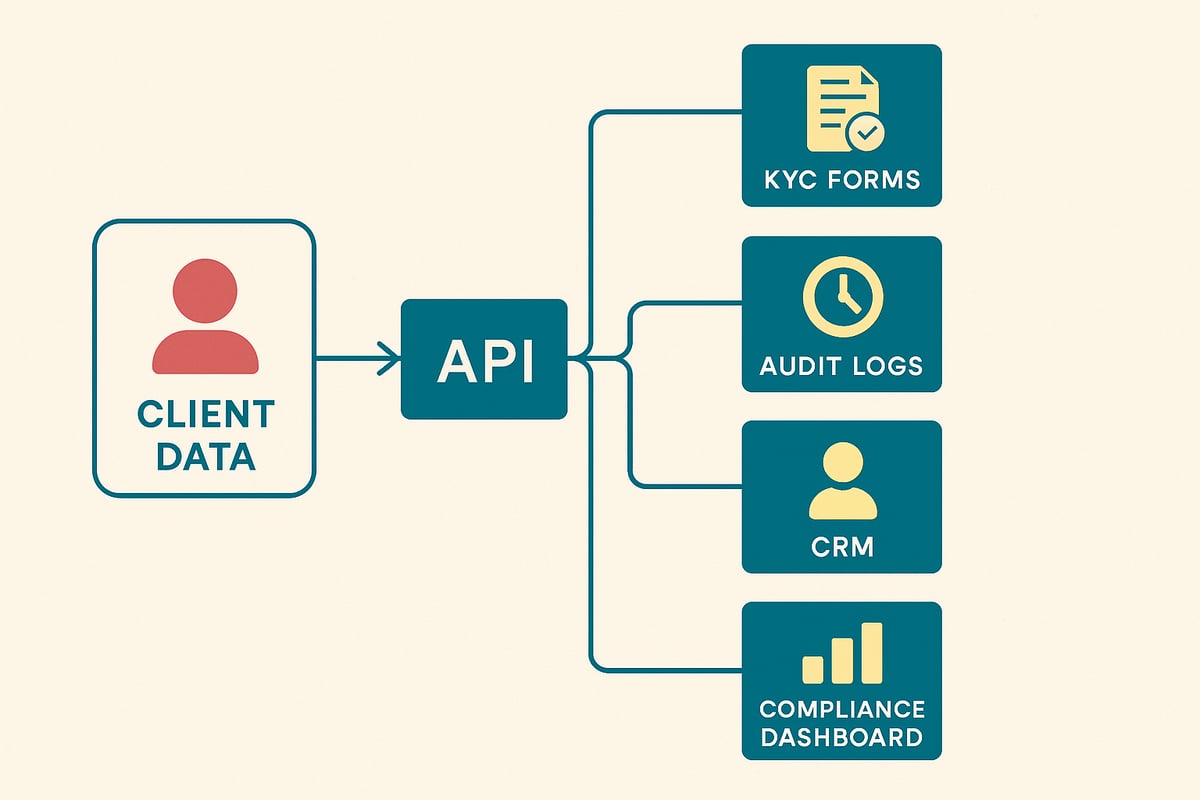

Structured compliance data goes beyond simply going digital. It refers to information that is machine-readable, rich in context, and integrated into internal systems through APIs. It’s also fully traceable, which is critical for audits and regulatory reviews. In short, structured data transforms one-off digital forms into live, connected data flows.

Unlocking New Possibilities

Once onboarding data is structured, everything changes. Enhanced due diligence can be triggered automatically based on client risk. KYC data can be reused across platforms without manual re-entry. Teams can monitor onboarding progress in real time. Every interaction becomes part of an auditable process. Structured data shifts onboarding from a passive process into an active engine for compliance.

Why It Matters in 2025

Onboarding is now a strategic function. Firms that modernize around data-first infrastructure are seeing meaningful improvements: onboarding timelines reduced by up to 80%, KYC and AML processes automated through real-time rules, and stronger collaboration between compliance, risk, and operations teams. In today’s landscape, structured KYC is no longer a nice-to-have—it’s foundational.

Making the Shift

You don’t have to overhaul everything at once. Start small:

Begin by identifying where data is interpreted manually or duplicated across tools. Collect onboarding information in structured formats from the start. Use API-first systems to connect your tools. Then, build logic that automatically triggers compliance actions based on client behavior or risk levels. These targeted changes can create the foundation for scalable, resilient onboarding.

Final Thoughts

Structured data is the building block for scalable, future-proof compliance. When information flows smoothly between tools and teams, firms gain speed, reduce manual work, and stay audit-ready. With the right systems in place, onboarding stops being a bottleneck—and becomes a strategic advantage.

If your team is thinking about KYC workflow automation or compliance integration, we’re happy to share what’s working across the industry.