In conversation with Mesh ID’s George Pedra, risk and analytics leader Atis Verdenhofs shares what it really takes to digitize risk management in complex, conservative environments. Based in the Middle East with roots in the Baltics, Atis offers a grounded view: automate wherever possible, respect the local context, and embrace your role as part compliance officer, part change agent—and increasingly, part IT strategist.

This blog explores the evolving role of systems in reducing human error, why transformation is never just technical, and how to future-proof risk models in regions where timelines stretch a decade or more.

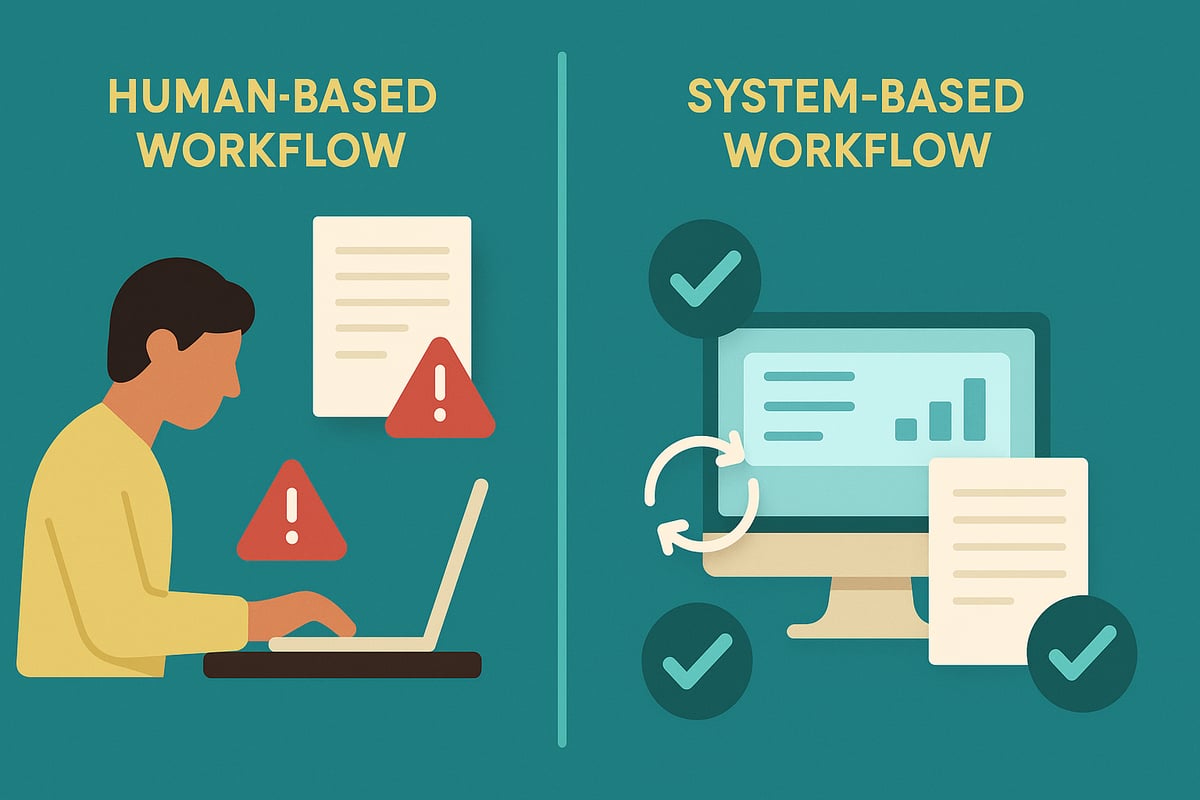

People Make Mistakes. Systems Don’t.

Atis Verdenhofs puts it plainly: “People equal bad, system equals good.”

It’s a blunt way of making a sharp point-human judgment is inconsistent. In areas like credit scoring or onboarding, small errors snowball fast.

Whenever there’s manual input-data entry or subjective calls-risk creeps in. Even small overrides from staff (“I know this person, it’s fine”) add bias to systems meant to reduce it.

Automation isn’t about replacing people. It’s about designing for consistency, tracking, and scale.

Culture Is a Bigger Variable Than Technology

Atis has worked across the Baltics, Nordics, Russia, and the Middle East. What stands out most? Culture.

In Sweden, process is law. If it’s written down, it gets done.

In the Middle East, relationships often override procedures. “People come to branches just to talk. They like the interaction. That’s hard to digitize,” he says.

This isn’t a tech problem-it’s a people dynamic. Trust in systems takes time. Especially in cultures where the human connection is the service.

What Works in One Region Might Fail in Another

“We had success digitizing lending in the Baltics-three clicks, instant decision,” Atis says. “Tried it in the Middle East? It failed.”

Why? Trust isn’t there yet. Legal infrastructure is patchy. Mobile adoption is slower. What feels obvious in one market can fall flat in another.

Localization means more than translation. It includes product scope, education pace, support expectations, and risk thresholds.

Balancing Innovation With Realism

In conservative markets, zero risk is often the goal. But that doesn’t align with how fintech works.

Atis helps teams shift that mindset. “You have to show regulators and staff what risk really looks like-what happens in the worst case and how you contain it.”

Education is the key. You’re not just enforcing policy-you’re teaching risk tolerance across product, compliance, and tech teams.

Risk Teams Are Becoming Tech Teams

Most of Atis’ time is now spent on systems: vendor SLAs, integration plans, IT decisions.

“Risk used to mean monitoring people,” he says. “Now it’s about managing platforms.”

If your compliance stack runs on third-party tools, that stack becomes part of your risk posture. Managing systems becomes core to the role.

Crisis Is Still the Best Catalyst

Planning is essential. But crisis moves things faster.

COVID forced document collection to go digital. The 2008 crisis pushed Baltic lenders to automate.

In each case, sudden pressure made institutions rethink how they handle compliance.

“You can’t wait for a crisis to digitize,” George adds. “But you can plan like one’s coming.”

Hide the Complexity. Keep the Experience Simple.

Great compliance systems feel simple. “It’s like a duck,” George says. “Calm on top, paddling like mad underneath.”

Behind-the-scenes, your stack might be verifying documents, screening names, fetching data. But for the user, it should feel like a smooth ride.

That’s why UI/UX matters in compliance. It’s not just about regulation-it’s about trust.

Play the Long Game

Governments in the Middle East are starting to embrace digital ID, e-signatures, and centralized registries. But progress is uneven.

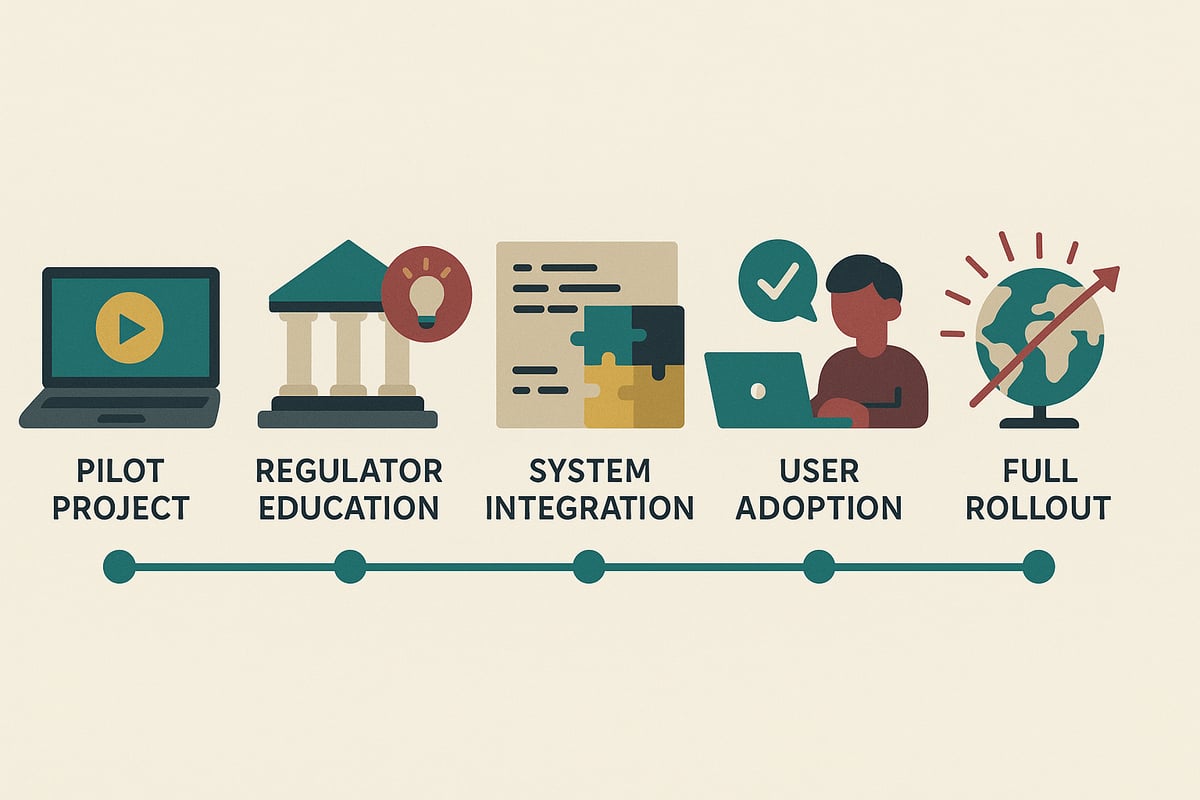

Atis’ advice? Start small. Pilot. Educate. Align with the local culture. And don’t push faster than the market is ready to go.

“Sometimes it’s not about being first. It’s about being ready when the market is.”

Final Takeaway

Risk leadership today isn’t about saying no. It’s about building systems, shaping culture, and managing change.

Across markets, the same principles hold true: automate what you can, adapt where needed, and always design with the real world in mind.

Because even in the most tech-driven environments, people still run the show.