Investor onboarding has entered a new era. What was once a bold promise-faster onboarding through automation-is now a core expectation. Hyper-automated onboarding tools are transforming how fund managers operate, reducing delays, streamlining compliance, and turning onboarding into a competitive advantage.

Faster, Smarter Onboarding Is No Longer Optional

Traditional onboarding relied heavily on manual work: data entry, PDF documents, follow-up emails. These processes were slow, error-prone, and frustrating for both teams and investors.

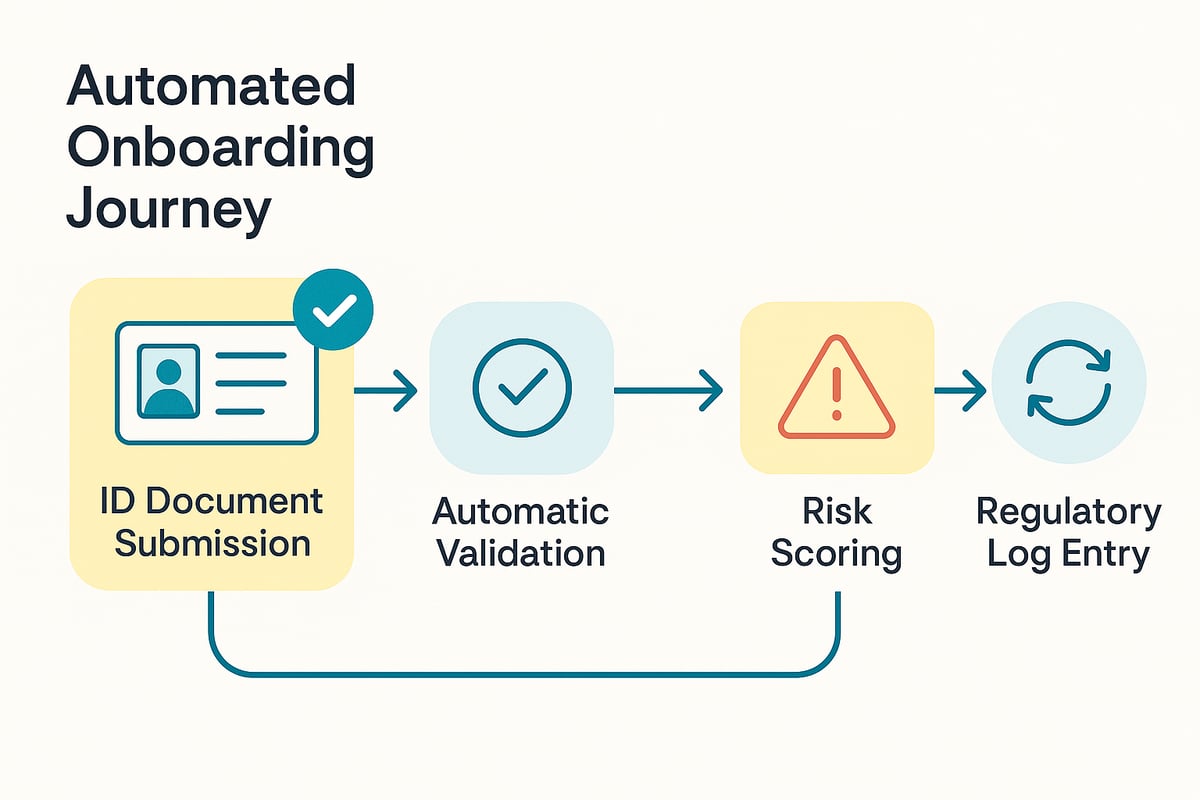

Now, leading firms are using platforms like Mesh ID to automate everything from data capture to ID verification. What once took weeks can now be done in hours. Risk profiles trigger workflows automatically. Investor data is synced across systems in real time. And everything is logged for audit readiness.

Accuracy Without the Manual Effort

Compliance teams know that inaccurate or outdated data can trigger risk. Hyper-automated onboarding solutions reduce that risk by validating and cross-checking data automatically. When an investor submits an ID or fills in a form, the system checks it instantly - flagging inconsistencies, verifying formats, and syncing records across the platform.

The result? Clean data, lower risk, and fewer manual corrections down the line.

Reducing Costs and Redundancy

Manual onboarding isn’t just slow - it’s expensive. Staff time goes toward tasks that should be automated. Errors cause rework. Investor frustration leads to drop-off.

By removing these friction points, hyper-automated onboarding tools help firms reduce operating costs, scale more efficiently, and focus resources on high-value work like risk review and relationship building.

What Investors Expect Today

Today’s investors - especially younger, digital-native clients - expect onboarding to be fast, simple, and fully online. If your process still relies on PDFs and email follow-ups, you’re likely losing capital before it’s even invested.

Modern onboarding platforms meet these expectations with features like:

• Smart document checklists based on jurisdiction and risk profile

• Real-time status tracking in a secure investor portal

• Fewer manual touchpoints and faster approval times

This improves not only speed but also the investor experience - a key factor in winning and retaining capital.

Where Onboarding Goes From Here

Hyper-automated investor onboarding isn’t a futuristic concept. It’s the new standard. Fund managers using platforms like Mesh ID are cutting onboarding times by up to 80 percent, improving compliance readiness, and building a more modern, scalable investor experience.

If your team is still relying on manual onboarding processes, now is the time to rethink your infrastructure. We’re happy to share what’s working for firms leading the way.